Contractor paycheck calculator

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major.

Hourly Paycheck Calculator Calculate Hourly Pay Adp

As a W2 employee you have the convenience of receiving a regular paycheck and employer-provided benefits without having to.

. 2017-2020 Lifetime Technology Inc. For a more robust calculation please use QuickBooks Self-Employed. As a 1099 earner youll have to deal with self-employment tax which is basically just how you pay FICA taxes.

If you want to get extra fancy you can use advanced filters which will allow you to input. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ad Create professional looking paystubs.

A perfect calculator for the independent contractor to figure out what their take home pay is going to be after taxes. This calculator is intended for use by US. Self-employed individuals need to pay self-employment tax which is 153 of your net business income as well as state and federal income tax.

They are based on MS Excel spreadsheets we use ourselves and converted into web. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Conversely employees incur costs contractors do not and contractors have a right to ask for the savings. All you need is the following information. Ad Explore Paycheck Tools Other Technology Users Swear By - Start Now.

However contractors incur costs employees do not which they have a right to charge employers for. Compare your income and tax situation when you work as a W2 employee vs 1099 contractor. In a few easy steps you can create your own paystubs and have them sent to your email.

All Services Backed by Tax Guarantee. Fixed expenses are subject to. The average number of hours you work per week.

Federal New York taxes FICA and state payroll tax. Working 52 weeks per year. The combined tax rate is 153.

The umbrella calculator is based on several assumptions. There are two paycheck calculators that compute paychecks for employees in Illinois and New York. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

We have designed a series of contractor calculators to help work out your tax liabilities. Under FICA you also need to withhold 145 of each employees taxable. The average cost of business-related expenses per week.

The calculators are for illustration purposes only and are based on a series of assumptions. The taxes you need to pay. If you have questions about Americans with Disabilities Act Standards for Accessible Design please contact 916 372-7200 or PPSDWebmasterscocagov.

As the employer you must also match your employees contributions. You can simply plug in your expenses and operational costs to decide what to charge your clients. It can also be used to help fill steps 3 and 4 of a W-4 form.

Calculate your total income taxes. Online since 1999 we publish thousands of articles guides analysis and expert commentary together with our. Ad Get Started Today with 2 Months Free.

Normally the 153 rate is split half-and-half between employers and employees. The maximum an employee will pay in 2022 is 911400. FICA consists of your federal Social Security tax 124 and Medicare tax 29 for a total self-employment tax rate of 153 of your net business income.

To manually determine your hourly rate add your personal expenses operating costs and development costs then divide the sum by the total billable hours. For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404. Use our calculator to get an estimate of your take home pay.

Payroll So Easy You Can Set It Up Run It Yourself. Whether youre a contractor that is working inside or outside IR35 our calculator can provide you with a take home pay estimate should you decide to work through an umbrella company or a limited companyIf youd like a more detailed take home pay illustration please fill in the form at the bottom of this page and well be. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

Get 3 Months Free Payroll. We use the most recent and accurate information. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

Paying taxes as a 1099 worker. How to calculate annual income. Self-employed individuals need to pay self-employment tax which is 153 of your net business income as well as state and federal income tax.

This calculator provides an estimate of the Self-Employment tax Social Security and Medicare and does not include income tax on the profits that your business made and any other income. Get Your Quote Today with SurePayroll. California and State with No Income Tax.

Just enter your gross pay pay period filing status state and local tax rates along with pre-tax deductions such as. The city and state where you work. Updated for 2022 tax year.

If you receive a Form 1099 you may owe self. Contract pay calculator Being a contractor has many legal and financial benefits over being an employee as well as a sense of independence. 2018 Self-Employed Tax Calculator.

Next divide this number from the annual salary. Contract pay calculator Being a contractor has many legal and financial benefits over being an employee as well as a sense of independence. The tools incorporate a range of variables including IR35 and whether you work via your own limited company or via an umbrella company.

How do I calculate hourly rate. However an independent contractor pay calculator is the easiest way to determine your rate. We use the most recent and accurate.

Use this calculator to view the numbers side by side and compare your take home income. Contractor Calculator the UKs authority on contracting serves a readership of over 200000 visitors per month see latest traffic report made up of contractors from IT telecoms engineering oil gas energy and other sectors. Using our self employment tax calculator is simple.

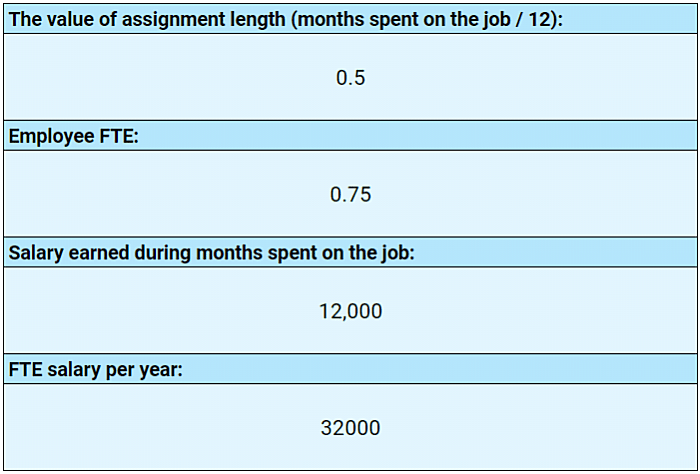

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Formula

Salary Calculator Convert Wage Into Hourly Monthly Annual Income

Consultants Vs True Cost Of Employees Calculator Toptal

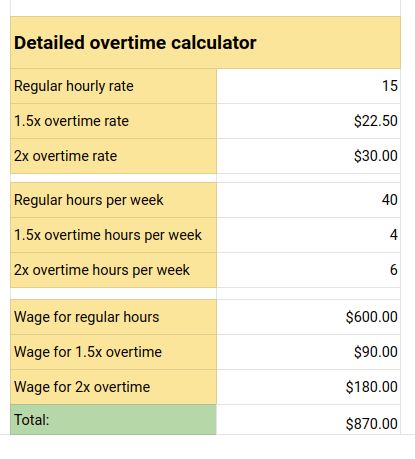

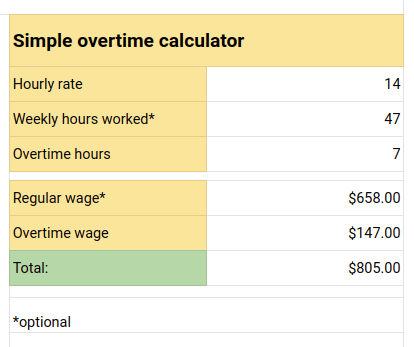

Overtime Pay Calculators

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

2022 Salary Paycheck Calculator 2022 Hourly Wage To Yearly Salary Conversion Calculator

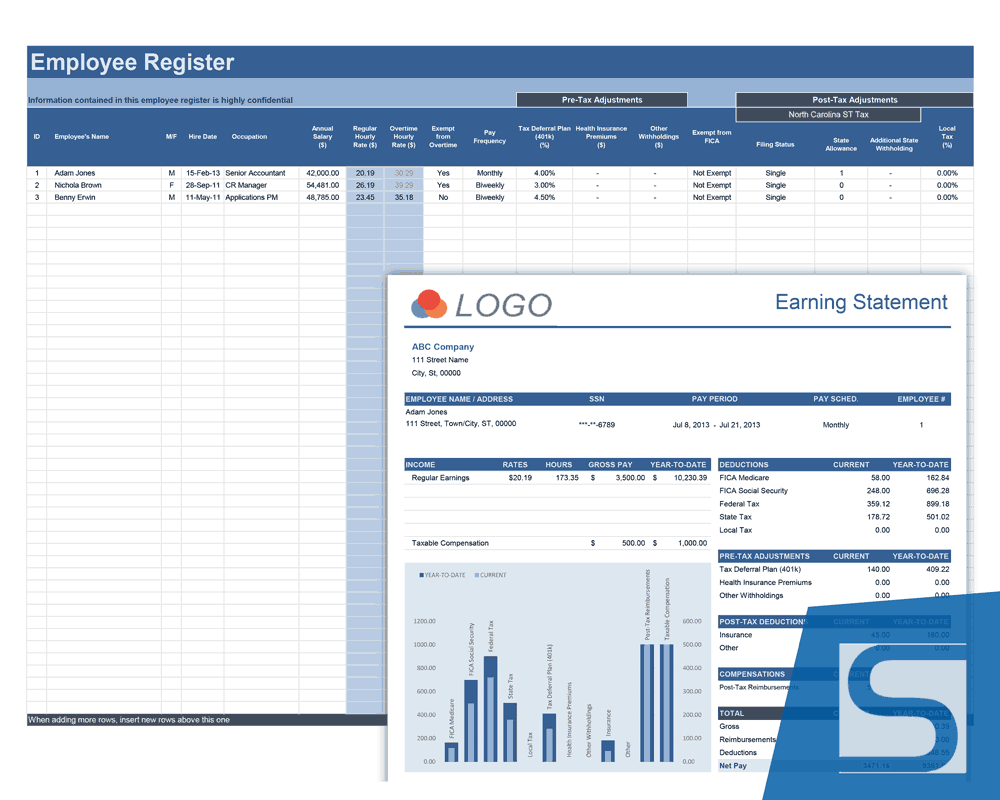

Payroll Calculator Free Employee Payroll Template For Excel

Avanti Gross Salary Calculator

Paycheck Calculator Online For Per Pay Period Create W 4

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Overtime Pay Calculators

Consultants Vs True Cost Of Employees Calculator Toptal

2022 Salary Paycheck Calculator 2022 Hourly Wage To Yearly Salary Conversion Calculator

Gross Pay And Net Pay What S The Difference Paycheckcity